- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The Europe composites market size was valued at USD 16.6 billion in 2018 and projected to grow with a 7.5% CAGR over the forecast period, from 2019 to 2025. Rising demand for lightweight materials across several industries such as transportation, aerospace & defense, wind, and automotive is expected to drive the market growth. Moreover, factors like rising product demand from the automotive industry and growing demand for wind energy applications are driving the market growth.

Composite materials play a vital role in the manufacturing of aircraft and automotive crafts. Rising concerns regarding harmful gas emission and fuel consumption are enforcing manufacturers to develop lightweight automotive components, which are expected to impel the demand for carbon fiber composites over metal components. Technological advancement to reduce manufacturing process time is projected to drive the demand for composites in the automotive sector.

The growing need for high-quality composite materials in the automotive sector is projected to rise in investment for developing new manufacturing technologies. Markey players such as Teijin Limited, SGL Group, Hexcel Corporation, and Toray are using their patent technologies to manufacture composites. SGL Group collaborated with several academic institutes and research centers to develop CFRP materials.

Growing fuel prices have boosted the demand for fuel-efficient vehicles, wherein composites play an important role to reduce vehicle weight as a replacement for steel, wood, and aluminum. Stringent environmental regulations implemented by European Union have urged manufactures to increase the usage of composites in automotive production. Stringent government regulations to reduce CO2 emission by government across several countries in this region are expected to surge the product demand in the automotive sector.

Aerospace is the fastest growing sector in Europe. The application of composites for manufacturing aircraft parts is increasing due to their high rigidity and lightweight attributes. Hence, the demand for composites has increased owing to growing demand from the aircraft manufacturers manufacturing sector including Dassault Aviation and Airbus, as aerospace and defense is one of the key sectors in Europe.

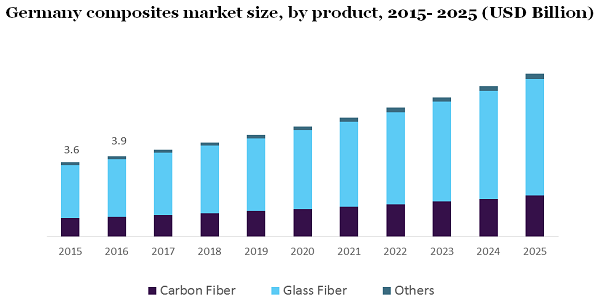

Based on products, the European composites market is segmented into glass fiber, carbon fibers, and others. Carbon fiber product is expected to grow with the fastest CAGR over the forecast period. It consists of carbon items that are bonded together in crystal form and mix with other materials to form composites. Carbon fibers are molded with plastic resins to produce carbon fiber-reinforced polymer. This fiber has several properties like low thermal expansion, high stiffness, high temperature, high chemical resistance, and low weight, which is widely useful in industrial and other operations.

In 2018, glass fiber held the largest market share. This fiber is made by the fine fiber of glass which is also known as fiberglass. This composite comprises several properties such as strong, lightweight, and strong material. However, glass fiber has lower stiffness compared to carbon fiber. The bulk strength and weight properties of glass fibers are extensively advantageous to other metals. The growth of wind energy and automotive industries will augment the demand for products in Germany over the forecast period.

The resins segment includes thermoplastic, thermosetting, and others. In 2018, the thermosetting segment held the largest market share of more than 71.0%. Thermosetting composites are synthetic materials and strengthen while heating but are very difficult to reshape and remold after initial heating. Hence, these materials are very tough owing to cross-linking and are suitable for high-temperature applications.

Thermoplastic gets hardened when cooled and retain their plasticity. This composite can reshape and remold by reheating. Thermoplastics are less toxic, recyclable, weldable, and non-toxic in nature.

Based on the manufacturing process, the European composites market is segmented into pultrusion process, resin transfer molding process, injection molding process, filament winding process, layup process, compression molding process, and others.

In terms of revenue, the layup process dominated the market in 2018. For composite production, the layup is the most common method. Growing production of boats, wind turbine blades, and architectural moldings are projected to drive the segment growth over the forecast period.

In 2018, the pultrusion process segment held the largest market revenue share of more than 22.0%. It is an efficient manufacturing process for producing fiber-reinforced composites. This process allows manufacturers to produce long lengths of fiber-reinforced polymer. For manufacturing composites, pultrusion is a resource-saving and efficient process.

In 2018, the injection molding process was valued at 202.5-kilo tons and projected to grow at a significant growth rate over the forecast period. This is a closed, fast, low-pressure, and high-volume process.

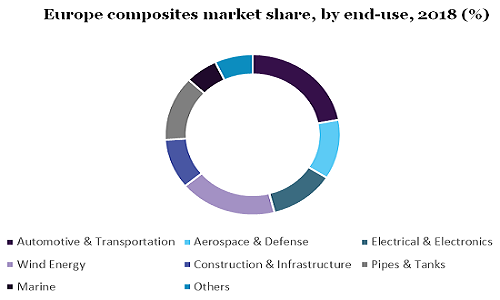

In 2018, the automotive & transportation segment was estimated at USD 3.6 billion. Several advantages like fuel efficiency and weight reduction associated with composites are majorly driving the market growth in the transportation segment. The lightweight and durability properties of composites are highly beneficial for manufacturing and designing automotive parts. Therefore, these composites are used to manufacture light rail and buses, as it increases fuel efficiency.

The aerospace & defense segment is expected to emerge the fastest growth rate of more than 7.0% in terms of volume from 2019 to 2025. Composites are majorly used to manufacture exterior and interior components of commercial aircraft, spacecraft, business jets, and military aircraft.

Composites are used in aerospace and defense sectors due to several advantages such as high aerodynamic performance, safety, stealth, and high reliability. Rising demand for superior and lightweights composites for commercial aircraft coupled with the growth of the aviation industry is anticipated to open new market growth opportunities in Europe over the forecast period.

Western European countries have dominated the largest market share, in 2018. This is due to the presence of construction, aerospace & defense, automotive, electronics, and electric industries. The penetration of new aircraft manufacturers in this region is projected to increase competition among key aircraft manufacturers, which is expected to propel the European composites market growth over the forecast period. In addition, significant demand for composites in the defense sector will boost the market growth over the forecast period in Europe.

In Europe, Germany accounted for the largest market share, in 2018 and is expected to retain its position during the forecast period. The emergence of Future Combat Air System projects will drive the demand for composites by aerospace application.

U.K. is projected to grow at a CAGR of over 6.0% in terms of revenue over the forecast period. Rising demand for products by electronic and electrical sectors is majorly fueling the market growth in this country. In addition, significant growth of the marine industry in the U.K is projected to drive the market growth over the forecast period.

The outbreak of the COVID-19 virus has negatively impacted the market. In Europe, governments across several countries such as Germany, U.K., Spain, and others have imposed lockdowns and stopped physical business operations of numerous industries including aerospace & defense, marine, automotive and electrical, and electronics to prevent the spread of the virus infection. This scenario has declined sales of composites in Europe.

However, several countries in Europe are looking for a fast recovery from economic crises which is expected to drive the demand for composites across end-use verticals post-pandemic.

The major manufacturers included in the market are Teijin Limited, Owens Corning, Toray Industries, and Hexcel Corporation. To gain market share in this competitive market, companies are adopting several marketing strategies such as mergers & acquisitions, partnerships, collaborations, and capacity expansions. In addition, key market players have their patented manufacturing technologies and are used at all value chain stages.

|

Attribute |

Details |

|

The market size value in 2019 |

USD 17.88 billion |

|

The revenue forecast in 2025 |

USD 27.54 billion |

|

Growth Rate |

CAGR of 7.5% from 2019 to 2025 |

|

The base year for estimation |

2018 |

|

Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2019 to 2025 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Resin, manufacturing process, end-use, region |

|

Regional scope |

Europe |

|

Country scope |

Germany, France, U.K., Spain, Italy |

|

Key companies profiled |

Toray Industries, Owens Corning, Hexcel Corporation, Solvay, and Teijin Limited. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at country and state levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For this study, Million Insights has segmented the Europe composites market report based on product, resin, manufacturing process, end-use, and country:

• Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2015 - 2025)

• Carbon Fiber

• Glass Fiber

• Others

• Resin Outlook (Volume, Kilo Tons; Revenue, USD Million, 2015 - 2025)

• Thermosetting

• Thermoplastic

• Others

• Manufacturing Process Outlook (Volume, Kilo Tons; Revenue, USD Million, 2015 - 2025)

• Layup Process

• Filament Winding Process

• Injection Molding Process

• Pultrusion Process

• Compression Molding Process

• Resin Transfer Molding Process

• Others

• End-use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2015 - 2025)

• Automotive & Transportation

• Aerospace & Defense

• Electrical & Electronics

• Wind Energy

• Construction & Infrastructure

• Pipes & Tanks

• Marine

• Others

• Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2015 - 2025)

• Germany

• France

• U.K.

• Spain

• Italy

• Rest of Europe

Research Support Specialist, USA