- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global eyewear market size was accounted for USD 138.7 billion in 2019 and expected to register 8.1% CAGR over the forecast duration, 2020 to 2027. Rising focus on quality and introduction of optical brands made up of premium materials are attributing to the growth of the market. In the recent past, there has been an increase in the number of eye-based diseases owing to the rising use of smartphones, TV, and laptops. In addition, the geriatric population is vulnerable to eye-related diseases. These factors are projected to spur the product demand over the forecast duration.

Owing to the changing trend of buying eyewear, manufacturers are introducing trendy products to cater to the increasing demand. For example, in the early 80s and 90s, thin metal frames were popular, but now, rounded glass with thin metal frames is gaining traction. The lightweight of thin metal-framed glass is a major factor driving its demand.

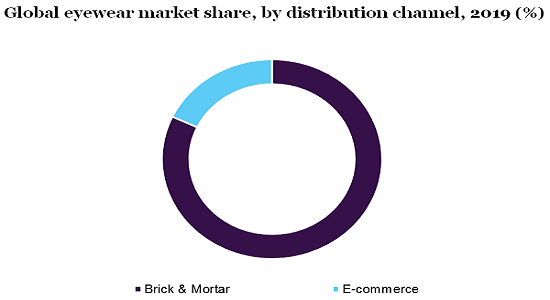

Over the past few years, sales of eyewear through e-commerce have gained traction. These sites are designed in a convenient way to offer buyers multiple choices. In addition, facial analysis and product visualization are playing key roles in driving the e-commerce sales of the product. Based on past purchasing behavior, e-commerce tends to recommend personalized products to consumers.

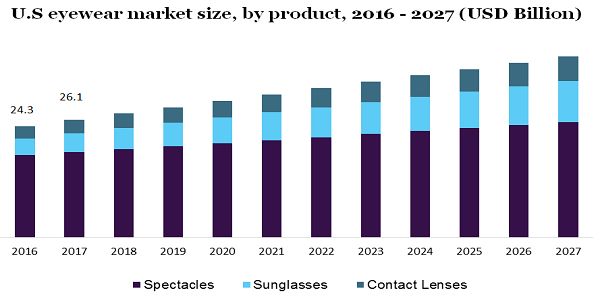

Based on the product, the spectacles segment held the largest share in the eyewear market in 2019. Technological developments have led to the introduction of durable and comfortable spectacles. Manufacturers are producing lenses that have higher indexes along with aesthetically appealing designs. Emerging companies such as Dresden Optics Pty have introduced a new business model that allows consumers to customize the design of their frames. This has enabled the company to produce cost-effective spectacles on a large scale.

On the other hand, the contact lenses division accounted for around 9.0% share in the market. Contact lenses are known to provide aesthetically appealing looks and enhanced features compared to glasses. In the recent past, there has been a transition towards the use of silicone incorporated polymer for manufacturing contact lenses.

In 2019, the brick & mortar segment accounted for the highest share in the market. Considering the growing popularity of offline stores, key players are focusing on increasing their reach into the different parts of the world. For example, Warby Parker offers its product only through online channels, but now the company is aiming to expand its reach in the brick & mortar market. In addition, certain players such as eyebrows, LLC have introduced systems where consumers can order the product online and then collect it from physical stores.

However, the e-commerce segment is gaining traction in the recent past, largely because of growing millennials participation. In addition, online portals have adopted innovative strategies that allow customers to upload their photos and check the looks of glasses and their suitability. Moreover, e-commerce sites are providing enhanced customer support owing to chatbots integration into their system.

In 2019, Asia Pacific accounted for the highest share in the market. The increasing number of people with myopia issues in China is driving the demand for corrective eyewear. In addition, leading market players like PRADA are operating in China owing to the availability of low-cost labor and easy access to various technology.

On the other hand, North America also held a considerable share in the market in 2019. In the United States, there is a robust system in place to counter the sales of counterfeit products. As per the Federal Trade Commission (FTC), it was revealed that the demand for independent Eyecare professionals is gaining traction as compared to retail chains. Besides, the increasing penetration of digital devices in the region is bolstering the demand for eyewear products.

The outbreak of COVID-19 has affected various industries and the eyewear market was no exception. The pandemic has caused severe damage to the supply chain industry, thereby, disrupting the supply of raw materials. In addition, manufacturers have also decreased their spending on the development of innovative eyewear amid low demand.

However, with the systematic opening of the economy of various countries, the market is anticipated to recover in the near future. To strengthen their hold in the market, players can focus on strategic mergers & acquisitions. In addition, strengthening their online portfolio and partnerships with online vendors would help in consolidating their position.

Key players operating in the market include CooperVision, Carl Zeiss AG, Warby Parker, Bausch and Lomb Inc., and EssilorLuxotttica among others. These players are focusing on introducing new products with enhanced features to cater to the increasing demand. For example, Johnson and Johnson Vision introduced ACUVUE OASYS in 2019. This product has transition light intelligent technology.

The market offers low entry for new players, which, in turn, has resulted in the rise in the number of new entrants, thus, offering more buying options to consumers. The new players have gained significant traction in the market by providing handcrafted premium eyewear. For example, Wires Eyewear offers handcrafted eyewear that uses 3D technology for lens rims and metal wires for frames.

|

Report Attribute |

Details |

|

The market size value in 2020 |

USD 147.59 billion |

|

The revenue forecast in 2027 |

USD 255.28 billion |

|

Growth Rate |

CAGR of 8.1% from 2020 to 2027 |

|

The base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Revenue in USD million, volume in million units, and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Vietnam; Japan; Brazil; Mexico |

|

Key companies profiled |

Bausch and Lomb Inc.; Carl Zeiss AG; Charmant Group; CooperVision; Warby Parker; EssilorLuxotttica |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Million Insights has segmented the global eyewear market report based on product, distribution channel, and region:

• Product Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

• Contact Lenses

• Premium Contact Lenses

• Mass Contact Lenses

• Spectacles

• Spectacle Frames

• Type

• Premium Spectacle Frames

• Mass Spectacle Frames

• Style

• Round

• Square

• Rectangle

• Oval

• Others

• Spectacle Lenses

• Sunglasses

• Lens Type

• Polarized Sunglasses

• Non-Polarized Sunglasses

• Lens Material

• CR-39

• Polycarbonate

• Polyurethane

• Others

• Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

• E-Commerce

• Brick & Mortar

• Regional Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

• North America

• The U.S.

• Canada

• Mexico

• Europe

• Germany

• The U.K.

• Asia Pacific

• China

• India

• Japan

• Vietnam

• South America

• Brazil

• MEA

Research Support Specialist, USA