- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

With reference to the report published, the global flue gas desulfurization (FGD) market was prized by USD 25.1 billion in 2019. It is estimated to witness a 4.8% CAGR during the period of the forecast.

Execution of strict standards for the air quality, to decrease SOx discharge stages, is expected to power the enlargement of the market for flue gas desulfurization, during the forecast period. Growing demand for electricity, together with major funds in thermal power generation units in the Asian nations is, moreover, anticipated to fuel the expansion of the market.

Besides, the existence of strict rules, regarding the release of gases together with the increasing demand for FGD arrangements in South Africa, Indonesia, Vietnam, and India, is expected to raise the demand for the product, during the forecast period.

The Chinese government’s concentration on inspiring the financial system by way of investments and the latest move towards energy safety has put aside worries, regarding the fiscal possibility, overloading, and surroundings. This is anticipated to outpour the demand for the FGD, during the forecast period.

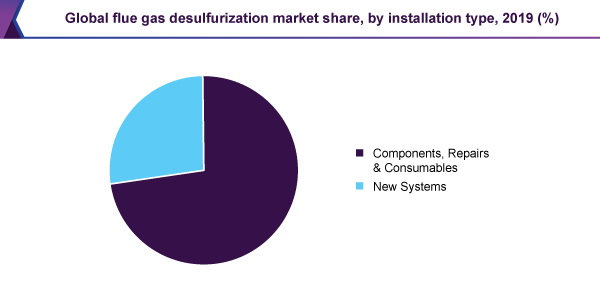

The acquisition of the new-fangled system is likely to decline, during the upcoming years. Thus the market for substitution components is bigger than that for new-fangled mechanisms. Since these power plants produce a huge amount of dangerous air contaminants, air pollution from coal-fired power generation plants sources a severe threat to human fitness. These air impurities can source, harm to the breathing passageway, eyes, brain, and skin.

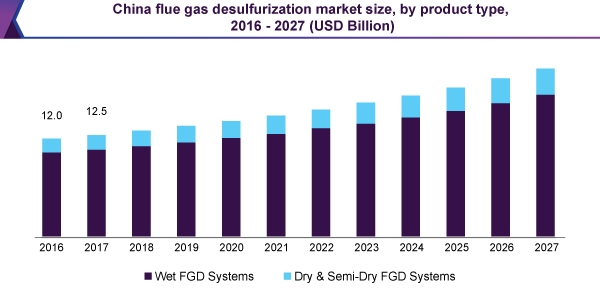

In 2019, the wet FGD system type sector held the major above 85.0% share and ruled the flue gas desulfurization (FGD) market. The maximum efficiencies of SOx elimination are attaining by wet FGD systems; it is above 90.0%. On the other hand, the lowest effectiveness, approximately 80.0%, is attained by dry FGD systems.

Due to their potential exercise of by-products, additional flexibility for fuel, as well as smaller working plus reagent expenses, over 85.0% of the flue gas desulfurization (FGD) systems set up, globally, are wet systems. Besides, these systems could offer equal to 99.0% elimination efficiencies and contain the capability to take away the corroded mercury, also.

The components, repairs, & consumables sector held, more than 72.0% general share, and dominated the flue gas desulfurization market, in 2019. Because of the greater yearly expenditure of FGD systems, this consists of repair & maintenance expenses, reagents costs, O&M labor expenditure, wastewater treatment overheads, auxiliary power, and others, the components, consumables, & repair market is increasing.

The life cycle expenses for FGD systems are on the upper side than the principal costs, causing the generation of opening for the third-party service supplier, in this manner, raising the expansion of the sector.

In 2019, Asia Pacific held above 74.0% share and dominated the global FGD market. The state will further increase by the highest CAGR, during the forecast years. As a result of the flue gas desulfurization execution strategy, during 2018-2022, in India, the FGD arrangement is estimated to witness a gush in demand. Consistent with the Indian Ministry of Environment, Forest, and Climate Change (MoEFCC) standards, 161,522 MW of thermal plants must restrict their SOx release, by means of installing FGD arrangements, not later than December 2022.

The Central Electricity Authority prepared proposals, in September 2018, to incentivize the in advance setting up of machinery for pollution control. This has, additionally, inspired the expansion of the market, in the current time. In 2018, Southeast Asia was the area where the participation of coal in the power mix has augmented. The demand for coal is expected to gradually increase, during the forecast period.

In line with the global energy monitor, South Korea, Vietnam, Bangladesh, and Indonesia, are the nations, anticipated to add an 18.6% share of the entire coal-fired power plant in the upcoming projects, during the near future. Consequently, the demand for the latest flue gas desulfurization arrangement is increasing, in the Asia Pacific.

On the other hand, since the developed nations are choosing for the coal phase-out, the market for new-fangled FGD structure in EU28 and North American nations is estimated to weaken. Rising apprehension concerning the standards of air quality, together with the growing incidences of respiratory problems, linked with air contamination, has enforced these nations to decide on greener options. This has additionally abridged the demand for new-fangled coal-fired power plants.

During the current times the Wuhan Kaidi, Fujian Long king Co., Ltd., and additional Chinese companies are the most important suppliers for flue gas desulfurization, in the world.

Bharat Heavy Electricals Limited (BHEL) has appeared as the key supplier company in India. The company has got two orders of value USD 334 million (INR 2500 Crores), in 2019, from the National Thermal Power Corporation (NTPC). BHEL has a technological alliance with Mitsubishi Hitachi Power Systems (MHPS). The company has got orders from many thermal units, which are above 50 numbers in quantity, for the supply of flue gas desulfurization (FGD).

• Wuhan Kaidi Electric Power Environmental Co., Ltd.

• Thermax

• Chiyoda Corporation

• General Electric

• Fujian Longking Co., Ltd.

• Mitsubishi Hitachi Power Systems

• Babcock & Wilcox Company

|

Report Attribute |

Details |

|

The market size value in 2020 |

USD 25.9 billion |

|

The revenue forecast in 2027 |

USD 36.6 billion |

|

Growth Rate |

CAGR of 4.8% from 2020 to 2027 |

|

The base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Revenue in USD million and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, installation type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

The U.S.; Canada; Mexico; Germany; The U.K.; Russia; China; India; Japan; Indonesia; Brazil; South Africa |

|

Key companies profiled |

General Electric; Babcock & Wilcox Company; Chiyoda Corp.; Mitsubishi Hitachi Power Systems; Thermax; Fujian Longking Co., Ltd.; Wuhan Kaidi Electric Power Environmental Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Million Insights has segmented the global flue gas desulfurization market report on the basis of product type, installation type, and region:

• Product Type Outlook (Revenue, USD Million, 2016 - 2027)

• Wet FGD Systems

• Dry & Semi-Dry FGD Systems

• Installation Type Outlook (Revenue, USD Million, 2016 - 2027)

• New Systems

• Components, Repairs, & Consumables

• Regional Outlook (Revenue, USD Million, 2016 - 2027)

• North America

• The U.S.

• Canada

• Mexico

• Europe

• Germany

• Russia

• The U.K.

• The Asia Pacific

• China

• India

• Japan

• Indonesia

• Central & South America

• Brazil

• The Middle East & Africa

• South Africa

Research Support Specialist, USA