- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global aircraft maintenance repair and overhaul (MRO) market size was accounted for USD 75.71billion in 2018. It is projected to grow at the CAGR of 4.7%over the forecast period,2019 to 2025. Aircraft maintenance involves different multifaceted activities such as maintenance repair, Servicing, and overhaul (SMRO). All these key tasks are performed by OEMs. These services are also outsourced to service providers of aerospace engineering (ESP). These ESPs track on servicing activities and ensure maximum efficiency.

Airline companies invest a large amount of money in MRO activities, with a focus on providing safety and security to their crew and passengers. Key OEMs such as Airbus, Boeing, and others emphasize new technologies like aircraft maintenance tools in MRO service. All these OEMs spending on aircraft maintenance services, which, in turn, is expected to foster market growth.

In addition, different engine development activities along with aircraft modernization are also expected to support the demand for aircraft services. Moreover, the use of the refurbished parts is on the rise for engine maintenance. Thus, these factors are expected to propel the aircraft’s parts demand. This demand is projected to get double in the coming decade.

Commercial sector development in the aviation industry is also increasing the demand for MRO services. For example, the launch of the new-generation type fleet requires new expertise and contemporary material designs.

Furthermore, the growing trend of low-cost carriers in the aerospace industry is expected to open up opportunities for MRO servicing market. These carriers are cost-sensitive which influencing MRO service providers to offer suitable services.

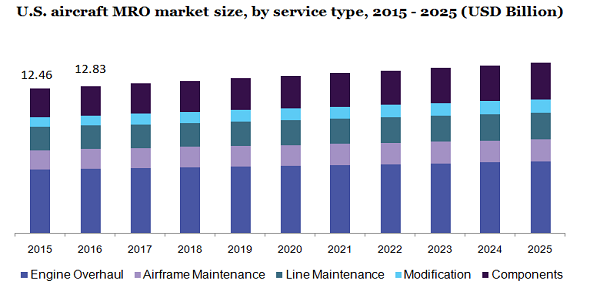

The aircraft MRO market is bifurcated into engine overhaul, line maintenance, airframe maintenance, components, and modification depending on the service type. In 2018, the engine overhaul type dominated the market with a share of over 40.0% in the overall market. The growing number of OEMs in aircraft services is projected to spur market growth.

Components type of service is estimated to grow at a CAGR of around 5.0% over the forecasted period. The growing aviation industry along with increasing flying frequencies is constituting cargo planes maintenance and repair activities.

The line maintenance service has attributed to over 15.0% market share in 2018. It is projected to grow at a significant rate in the coming few years. This service involves addressing in-service examination, and pre-determined schedule management.

In 2018, the independent MRO segment held the largest share in the overall market. It is estimated to account for over USD 47.0 billion by the end of 2025. The OEMs are focusing on outsourcing MRO services to different ESPs. This trend is expected to propel at a significant rate in the coming few years.

In addition, the OEMs are developing various maintenance programs with specific airplane types for aircraft MRO servicing. The OEMs monitor all manufacturing and design of service operations. This helps to analyze the aircraft's performance.

Moreover, the OEMs also offer customized maintenance operations to better maintain aircraft services. They also help to eradicate the redundant maintenance processes since it has a large data available for aircraft service analysis.

In 2018, the narrow-body type of aircraft segment led the aircraft maintenance repair & overhaul market with the highest share of over 50.0% in the overall market. The airline operators focus on updating their planes with factors like fuel efficiency and cost-saving, which, in turn, is boosting demand for the narrow-body type aircraft. For example, Airbus has upgraded its A320 to A320 neo with high fuel efficiency.

The Wide-body aircraft segment is projected to grow at the highest CAGR during the forecasted period. The increasing trend of turbofan engines is driving the growth of wide-body aircraft. Moreover, these aircraft require high MRO expenditure due to the high maintenance.

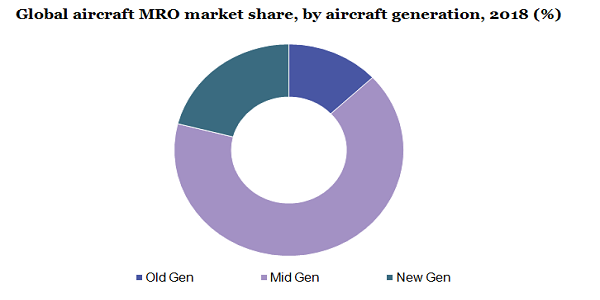

The mid-generation type segment is projected to hold the largest market share in the overall market by 2025. The growing applications of innovative technologies along with artificial intelligence is encouraging aircraft manufacturers to develop the planes by designing suitable MRO landscape, especially in mid-generation type planes.

The new generation type aircraft segment is projected to expand at the highest CAGR over the forecasted period. The development of new aircraft by replacing old generation planes with greater efficiency is supporting the segmental growth. The Asia Pacific is projected to be the key market for this segment.

In 2018, Asia Pacific accounted for the highest market share in the overall market. It is also projected to grow at the fastest CAGR over the forecasted period. Additionally, the increasing air traffic is anticipated to surge the market growth. China has over 5000 aircrafts available in its service. Furthermore, the growing demand for new planes and international trade activities is expected to boost the demand for MRO services. Moreover, OEMs are integrating services with the help of advanced technologies, especially in the European market. All these key factors are projected to positively impact the market growth.

COVID-19 has impacted the aviation industry drastically, as a result, there has been a reduction in productivity due to travel restrictions being imposed by governments across the globe. The production in aircraft manufacturing has been in a slowdown, the demand for aircraft over the next few years is not likely to get affected since the airline projects have been allocated before the pandemic situation. However, the manufacturers in the aviation industry may face cash-flow challenges owing to disruption in the supply chain.

Amid the coronavirus pandemic, there has been a significant reduction in air traffic owing to lockdown and international travel restrictions across the globe. For example, Air France has foreseen its air traffic decline to 1.8 million from 4.35 million in March 2020.

Leading players in the market include AAR Corp; Bombardier Inc.; Lufthansa Technik; GE Aviation; Delta TechOps; Hong Kong Aircraft Engineering Co. Ltd.; Air-France Industries KLM Engineering & Maintenance; Triumph Group, Inc.; and MTU Aero Engines AG.

The growing number of OEMs across the globe are expected to expand the MRO services industry in the next few years.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Billion & CAGR from 2018 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America &Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., China, Japan, India, and Brazil. |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For the purpose of this study, Million Insights has segmented the global aircraft MRO market report on the basis of service type, organization type, aircraft type, aircraft generation, and region:

• Service Type Outlook (Revenue, USD Billion, 2015 - 2025)

• Engine Overhaul

• Airframe Maintenance

• Line Maintenance

• Modification

• Components

• Organization Type Outlook (Revenue, USD Billion, 2015 - 2025)

• Airline/Operator MRO

• Independent MRO

• Original Equipment Manufacturer (OEM) MRO

• Aircraft Type Outlook (Revenue, USD Billion, 2015 - 2025)

• Narrow-Body

• Wide-Body

• Regional Jet

• Others

• Aircraft Generation Outlook (Revenue, USD Billion, 2015 - 2025)

• Old Generation

• Mid Generation

• New Generation

• Regional Outlook (Revenue, USD Billion, 2015 - 2025)

• North America

• U.S.

• Canada

• Europe

• Germany

• U.K.

• The Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Mexico

• Middle East &Africa (MEA)

Research Support Specialist, USA