- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

With reference to the report published, the global autonomous last-mile delivery market was prized by USD 10.7 million in 2019. It is estimated to witness a 32.4% CAGR from 2020 to 2027.

The rising need for quicker as well as lucrative distribution services, in conjunction with the emergent e-commerce segment, has increased the enlargement of the market for autonomous last-mile delivery. Additionally, speedy industrial growth plus the passionate startup environment in the robotics field are anticipated to impel the expansion of the market, during the estimated period.

Mainly, the last mile delivery is some of the major pricey portions of the logistics network. Frequently, it is corresponding to above 50.0% of the general expenditure. The e-commerce and logistics companies are fighting with options, to turn into extra proficient in distributing commodities and maintaining their charges as small as workable.

Thus, numerous logistics companies put emphasis on the happening of novel resolutions to decrease the charges, in addition, to mechanize last-mile distribution by making use of the autonomous motor vehicle capability, drones, and movable robots.

The increasing use of drones in the business segment, technical advancement, and financial support for the robotics project are the factors, estimated to considerably add to the expansion of the autonomous last-mile delivery market.

The present emergency of Covid-19 has placed a focus on the distribution done using autonomous robots. Between the pandemic, the businesses have recognized the reimbursement of touchless distribution arrangements like buying foodstuff as well as requisites even actually not visiting the occupied restaurants and shops along with following rules of social distancing.

The order for contactless distribution services is growing. This has directed lots of food joints, restaurants, and shops to connect with the pilot assignment of transporting foodstuff as well as provisions, by means of autonomous robots.

In 2019, the short-range (<20 kilometers) sector remained the major, above 90.0% revenue share of the autonomous last-mile delivery market. The autonomous delivery market is in a growing phase and diverse test assignments are being conducted for small distances.

Normally, these assignments are restricted to a precise region of the metropolitan area or university sites, covering restricted distances. Additionally, short of public knowledge and safety concerns reduce the use of robots for extended distances. Therefore, the division is anticipated to lead the market, during the projected period.

The long-range (>20 kilometers) sector is expected to record the maximum CAGR, throughout the calculated period. The enlargement of the sector can be credited to the increasing requirement for speedy as well as gainful parcel distribution, on lengthy distances. The enhancement of cargo flights and autonomous cars is estimated to speed up the development of the market, during the predicted period.

In 2019, the software sector retained a major, more than 60.0% market share. On the basis of the solutions, the autonomous last-mile delivery market is divided into service, software, and hardware.

The service sector is estimated to observe a solid 36.0% CAGR for the duration of the forecast. The companies, operational in the autonomous last-mile delivery network, are taking on the Robot-as-a-Service (RaaS) form.

In 2019, the hardware sector held a noteworthy market share. Robot hardware comprises radars, batteries, LiDAR, propulsion systems, cameras, sensors, and others. The progress of the Internet of Things (IoT) in robots plus abridged prices of cameras, sensors, and LiDAR, are anticipated to completely power the expansion of the market.

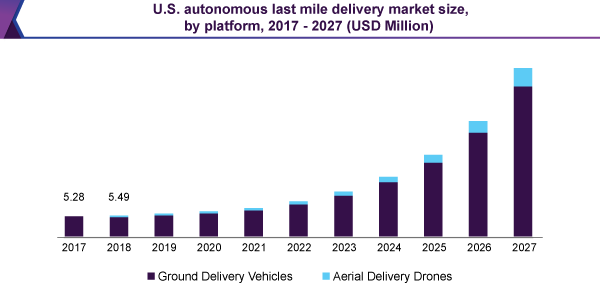

The ground delivery vehicles platform division retained the principal; more than 85.0% share of the autonomous last-mile delivery market, in 2019. It is anticipated to record a more than 30.0% CAGR, during the estimated period. The sector is additionally divided into self-driving trucks and vans plus the delivery bots.

Aerial delivery drones are estimated to observe healthy augmentation during the forecast period. Drones are a supportive way for package distribution, since they evade traffic overcrowding plus needless blocking of the roads, in addition, to decrease carbon track. The section is further segmented into hybrid types, fixed-wing, and rotary blades.

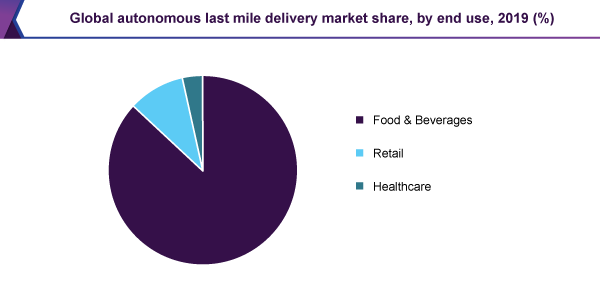

In 2019, the Food and Beverages (F&B) sector held more than 85.0% revenue share and dominated the autonomous last-mile delivery market. The Food and Beverages (F&B) segment is transforming its method of serving clientele, to stay sustainable within the aggressive market.

The robots, meant for food delivery, have by now started distribution of foodstuff products in chosen cities, along with the university campuses. Particularly, these robots are intended for the Food and Beverages industry, by way of dissimilar cubicles for cold and hot foodstuff products.

The retail segment is anticipated to record more than 38.0% CAGR, during the anticipated period. The growing expansion of the e-commerce sector is expected to call for sturdy logistics as well as a delivery system.

In 2019, North America held the biggest; more than 62.0% share of the global autonomous last-mile delivery market. This can be credited to the incessant improvement in autonomous delivery robots. This has caused many pilot schemes, within the region.

The U.S.-based robotics company, Starship Technologies, has initiated the distribution of food items by means of robots in some universities. These include the University of Wisconsin-Madison, the University of Pittsburgh, George Mason University, and Purdue University. The company is likely to begin its service for medications and groceries in additional portions of the U.S.

Amazon.com, Inc. is willingly concerned with the improvement of autonomous delivery robots. The company introduced Scout, a last-mile delivery robot in Southern California, in August 2019. Besides, incessant efforts are done by the retail monsters like Wal-Mart and The Kroger Co., to cut down the deliverance time. This is projected to power the need for the improvement of advanced delivery robots.

Europe is estimated to appear as a major state, during the approaching years. Intentionally designed cities like Paris and Copenhagen plus the best quality roads make simpler the robot function in jam-packed spaces. As against those in the North American nations, the pilot schemes in Europe, confront fairly fewer challenges.

Moreover, progress like Emqopter’s drone transport, Nokia’s autonomous delivery robot in the Paris-Sarclay site, as well as Starship Technologies food items distribution robots in Milton Keynes, U.K., are likely to power the expansion of the market for autonomous last-mile delivery, in Europe.

The market in Middle East & Africa is prepared to display remarkable development in autonomous robot deliveries. Tanzania, Rwanda, and Malawi, these African nations have founded themselves like a testbed for drones. Consistent with UNICEF, drones are able to perform a fundamental function in transporting emergency medicinal provisions, vaccines, and additional prerequisites, in Africa's isolated regions where shipping is the most important trouble.

In addition, the Dubai Future Accelerator and Roads & Transportation Authority (RTA) of Dubai are scheduling to begin tests for the drone distribution, in the near future.

The market is disjointed, by way of numerous startups as well as technology monsters, which are vigorously operational on technology improvement. Startups are placing themselves like a robot-as-a-service type industry. These companies are operational on structuring fleet management and route optimization software, together with the hardware.

Since logistics companies do not have the technical capability, they are likely to subcontract the autonomous last-mile delivery to these technology companies. On the other hand, logistics companies, together with in-house technology potential like Amazon, are not as expected to connect with the service form. These e-commerce companies are working out on their autonomous delivery robots and are likely to obtain technology startups to keep on aggressive, within the market.

• Wing Aviation LLC

• Udelv Inc.

• Starship Technologies

• Robby Technologies

• Nuro

• JD.com

• Drone Delivery Canada

• Alibaba

• Unsupervised AI

• TeleRetail

• Shenzhen Yiqing Innovation Technology Co., Ltd.

• Refraction AI

• Kiwi Campus (Kiwibot)

• Flytrex

• Amazon.com, Inc.

|

Report Attribute |

Details |

|

The market size value in 2020 |

USD 11.9 million |

|

The revenue forecast in 2027 |

USD 84.9 million |

|

Growth Rate |

CAGR of 32.4% from 2020 to 2027 |

|

The base year for estimation |

2019 |

|

Historical data |

2017 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Revenue in USD million and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Platform, solution, range, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; Japan; Brazil; Mexico |

|

Key companies profiled |

Alibaba; Amazon.com, Inc.; Drone Delivery Canada; Flytrex; JD.com; Kiwi Campus (Kiwibot); Nuro; Refraction AI; Robby Technologies; Shenzhen Yiqing Innovation Technology Co., Ltd.; Starship Technologies; TeleRetail; Udelv Inc.; Unsupervised AI; Wing Aviation LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2027. For this study, Million Insights has segmented the global autonomous last-mile delivery market report based on platform, solution, range, end-use, and region:

• Platform Outlook (Revenue, USD Million, 2017 - 2027)

• Ground Delivery Vehicles

• Delivery Bots

• Self-driving Vans & Trucks

• Aerial Delivery Drones

• Fixed-Wing

• Rotary-Wing

• Hybrid

• Solution Outlook (Revenue, USD Million, 2017 - 2027)

• Hardware

• Software

• Service

• Range Outlook (Revenue, USD Million, 2017 - 2027)

• Short Range (<20 Kilometers)

• Long Range (>20 Kilometers)

• End-use Outlook (Revenue, USD Million, 2017 - 2027)

• Food & Beverages

• Retail

• Healthcare

• Others

• Regional Outlook (Revenue, USD Million, 2017 - 2027)

• North America

• U.S.

• Canada

• Europe

• Germany

• U.K.

• The Asia Pacific

• China

• Japan

• Latin America

• Brazil

• Mexico

• Middle East and Africa

Research Support Specialist, USA