- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global buy now pay later market was prized by USD 4.07 billion in 2020. It is estimated to witness 22.4% CAGR from 2021 to 2028.

Buy Now Pay Later (BNPL) is a disbursement alternative, which permits consumers to do online procurement as well as at stores, with no need to shell out immediately the total amount. The rising knowledge regarding installment sourced disbursement process is likely to boost the enlargement of the market for buy now pay later.

Furthermore, the nonexistence of interest costs, charged by BNPL policy, is additionally projected to generate expansion openings for the market.

BNPL, normally, needs smaller wide-ranging credit confirmation as contrast to the additional category of retail funding. So, the clients having inadequate or small credit, who are not entitled for the conventional loan alternative, discover BNPL additionally attractive.

Buy now pay later is happening to be well-liked between the youngsters, which frequently have fewer funds to pay for their buying. Moreover, often it is extensively utilized by the online purchasers than in-store customers.

On the other hand, greater late fees charged via the suppliers of buy now pay later services are likely to hamper the expansion of the market, during the forecast period. Likewise, banks and credit suppliers, which present BNPL services, put charges on equally the customer as well as merchant. BNPL process invites greater charges, usually varying from 2% to 6% of the procured amount, in contrast to usual payment process. Furthermore, the incorporation of the BNPL method of payment into the shop’s sign out procedure necessitate specific tools, in addition to machinery, which can count up to the expenditure encountered by the business.

The eruption of Covcid-19 pandemic is likely to contain an optimistic effect on the market for buy now pay later procedure. Amid the calamity restraining family earnings through the world, the hunt for the liquidity has been raised and is likely to go on, during 2021. In addition, frequently, the banks are discouraged from offering credit in challenging financial surroundings. In these circumstances; BNPL resolutions assists clients for paying their bills in installment. Consequently, BNPL dealings have considerably amplified, throughout the Covid-19 pandemic.

The large enterprises division held more than 61.0% revenue share and led the global buy now pay later market, in 2020. Large enterprises are extensively implementing the buy now pay later disbursement resolution since, it presents clients a reasonably priced as well as adaptable payment procedure for buying high priced goods.

The small & medium enterprises division is projected to record the highest CAGR, during the forecast period. Small & medium enterprises, through the world, are concentrating on accepting BNPL resolutions to boost the speed of sales transfer.

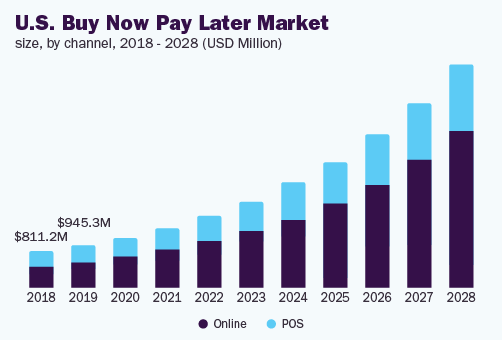

The online section held more than 63.0% revenue share and led the global market, in 2020. Globally, several businesses are likely to concentrate on accepting the highest increasing online payment process, like buy now pay later, as a part of their post-pandemic revival tactics. Throughout the Covid-19 pandemic, the rising change in purchaser state of mind, regarding the payment process, is anticipated to impel the expansion of the online section. BNPL resolutions present bi-weekly or monthly payments to facilitate simple procurements that are compensated above a time phase.

The POS section is projected to observe major development, during the forecast period. Globally, several businesses are concentrating on presenting Point-of-Sale (POS) BNPL funding opportunity to increase purchaser experience in addition to make stronger their association with clients. Besides, businesses present clients’ loyalty driven clear POS payment loan plans. Consequently, businesses are going through better shares of recurring consumers.

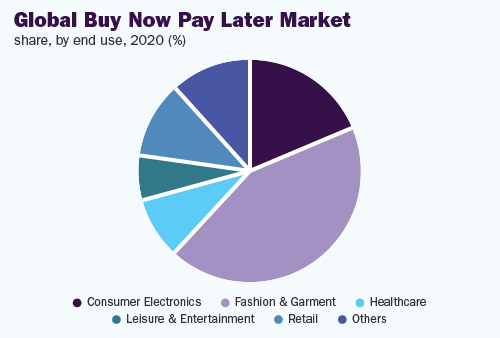

The fashion & garment section held more than 43.0% revenue share and led the global market, in 2020. The business is observing augmented acceptance of buy now pay later resolutions because they permit clients to effortlessly deal out the expenditures of the acquisitions above a period of time of preset as well as interest-free expenditure.

The consumer electronics section is likely to record an assured CAGR, during the forecast period. Since, they present a low-friction alternate to credit cards, the businesses are observing a growing acceptance of BNPL payment process. Besides, to stay away from the costly compounding interest as well as secret charges, consumers have a preference for BNPL payment system, in contrast to credit cards. Rising alertness between the consumer electronic suppliers regarding the supple BNPL payment process is anticipated to push the demand for buy now pay later services, during the forecast period.

In 2020, North America held more than 30.0% revenue share and led the global buy now pay later market. The development of the regional market can be credited to the existence of a huge number of well-known companies, within the region. Besides, the greater number of internet consumers, with in the region, is additionally estimated to generate expansion occasions for the market.

Due to the variety of paybacks it presents, like cash backs and discounts on bills, several consumers, during current years within the region, are making use of online payment via credit/debit cards, digital wallets, and buy now pay later platforms.

Asia Pacific is likely to witness the maximum CAGR, during the forecast period. BNPL movement is happening to be widespread through the region because it facilitates consumers to get into credit and postpone payments. The escalation in uptake of BNPL resolutions through the region has been, moreover, stimulated by Gen Z and millennial purchasers. The rising infiltration of mobile internet within the region is, more, likely to generate enlargement prospects for the local market, during the forecast period.

Buy now pay later is a helpful service for equally the merchants as well as consumers. The nature of the market is fairly disjointed. This method is turning into an ever more accepted for the consumers, to do purchases online and within-stores. A greater number of merchants are concentrating on taking online installment loans and on this point-of-sale channel. The increasing e-commerce business is more likely to steer the expansion of the market, during the forecast period.

|

Report Attribute |

Details |

|

Market size value in 2021 |

USD 4.95 billion |

|

Revenue forecast in 2028 |

USD 20.40 billion |

|

Growth rate |

CAGR of 22.4% from 2021 to 2028 |

|

Base year of estimation |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Channel, enterprise size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; U.K.; Sweden; China; India; Japan; Australia; Brazil |

|

Key companies profiled |

Afterpay; PayPal Holdings, Inc.; Affirm, Inc.; Klarna Inc.; Splitit; Sezzle; Perpay Inc.; Openpay; Quadpay, Inc.; LatitudePay |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. |

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Million Insights has segmented the global buy now pay later market based on channel, enterprise size, end use, and region:

• Channel Outlook (Revenue, USD Million, 2017 - 2028)

• Online

• POS

• Enterprise Size Outlook (Revenue, USD Million, 2017 - 2028)

• Large Enterprises

• Small & Medium Enterprises

• End-use Outlook (Revenue, USD Million, 2017 - 2028)

• Consumer Electronics

• Fashion & Garment

• Healthcare

• Leisure & Entertainment

• Retail

• Others

• Regional Outlook (Revenue, USD Million, 2017 - 2028)

• North America

• U.S.

• Canada

• Europe

• Germany

• U.K.

• Sweden

• Asia Pacific

• China

• India

• Japan

• Australia

• Latin America

• Brazil

• Middle East & Africa

Research Support Specialist, USA