- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

With reference to the report published, the global healthcare insurance market size was prized by USD 2.4 trillion in 2019. It is estimated to witness a 6.7% CAGR from 2020 to 2027.

Mainly, the market for healthcare insurance is pushed by the soaring prices of healthcare, increasing occurrences of chronic sicknesses, in addition to rising disposable income. Moreover, the central government has a major role in determining every feature of the health care subdivision. For example, the Affordable Care Act (ACA) put into action in the U.S., concentrates on increasing health coverage to those having low down earnings. The law wants to increase the class of healthcare services along with decrease the asking price of the treatment, thus increasing the exposure of insurance.

The insurance companies are concentrating on providing custom-made policies, due to the rising contest in the market, in addition to; fascinate the youngsters for upholding their share in the market. Deliverance of the custom-made services enhances client experience; fascinates clientele and maintains trustworthy clients. Globally, the majority of startups of the world, which are providing life insurance, are trying to concentrate on the requirement for personalized insurance.

The COVID-19 has produced, an optimistic influence on the healthcare insurance industry, since progressively; individuals have started spending on healthcare plans. Caused by the global pandemic, there has been an increase of 50.0% in the inquiry, associated with health policies. The eruption of coronavirus is almost certainly to encourage the enlargement of the market, in a comparatively less insured marketplace, by means of growing the infiltration percentage of the health coverage. People have well-timed understand the actuality that in these pandemic circumstances, the simple method to live money-wise sheltered is to procure a health policy.

In 2019, with a 59.8% revenue share, the adult sector led the healthcare insurance market. The section is, furthermore, expected to keep hold of its place, during the period of the forecast. There is a greater frequency of sicknesses, associated with the lifestyle, in the adult people, which is able to boost the threat for the health, in the upcoming period. The adult residents are extra prone to cardiac as well as additional sicknesses that necessitate hospitalization. Furthermore, in 2019, approximately 57.0% of the U.S. owns life insurance, in that way enhancing the expansion of the market.

The senior section seized a subsequent biggest 6.6% CAGR, in the market, throughout the forecast period. It comprises persons more than 65 years of age, who are additionally at risk to persistent sickness and therefore initiate an increased percentage of hospitalization.

The silver health plans division controlled the healthcare insurance market, and held a revenue share of over 55.0%, in 2019. Silver plans are mainly popular in the national market and state exchanges, by way of 70.0% of the typical clients prefer them. Generally, they are for persons, having some weak physical condition and necessitate certain medicine.

The sector of gold plans is projected to 7.6% CAGR, for the period of the forecast. This could be accredited to the escalating occurrence of the continual illnesses and require calling doctors, frequently, furthermore have need of costly medicine, which would be not possible to pay for out of the pocket.

The Preferred Provider Organization (PPO) subdivision directed the market and retained the 28.0% revenue share, in 2019. Generally, they are the familiar health plans and offer a sizeable set-up of healthcare providers, in order that the insured anyone has a lot of hospitals and doctors to prefer from. Besides, there is not much official procedure, necessary, which makes it a favorite, thereby increasing the expansion of the market.

In 2019, the life insurance sector ruled the healthcare insurance market and retained the principal revenue share of 53.3%. It is expected to lead the market, in the conditions of share of the market as well as the revenue, throughout the forecast period.

The sector of term insurance is projected to expand by 7.4% GAGR, during the period of the forecast. Basically, this is caused by its greater coverage and low price. Essentially it comprises healthcare insurance, which offers protection against the growing cost of medicinal treatment and in the situation of a health crisis, like serious sickness. Therefore, it is the most excellent method to defend medicinal operating costs.

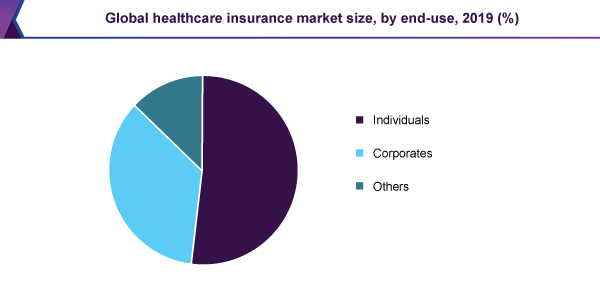

Amid 51.7% of the revenue share, the individual sector ruled the healthcare insurance market, in 2019. A vast number of citizens pay money for individual health plans since they are moreover custom-made. Furthermore, it provides extra control above the reimbursement restrictions, deductibles, as well as co-pays and it is not reliant on employment conditions.

The corporate sector is likely to expand by 7.1% CAGR above the forecast period. This might be by the reason of the low-down prices, linked with corporate plans in contrast to personal health plans. They propose, low-priced coverage for enhanced situations, and it is simpler to increase coverage, for the already existing conditions. However, they are valid merely until the member of staff is on employment.

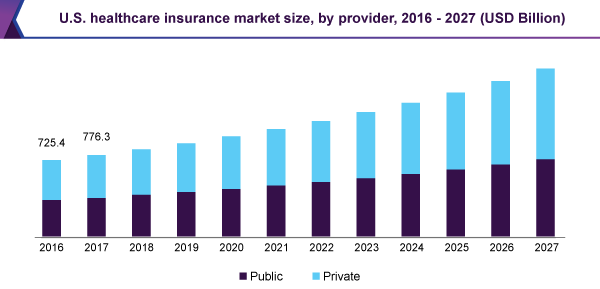

By holding a 55.6% share in 2019, the public sector directed the market. The central or state government is the major insurer and straight source of healthcare services. The centralized government is performing a most important responsibility in healthcare, ever since the organization of Medicare and Medicaid in 1965. In addition, public healthcare insurance is additionally reasonably priced, in contrast to private one. Normally, it needs, no deductibles and moreover has minor managerial expenses.

The private sector is expected to record the highest 7.0% CAGR, for the duration of the forecast. There is a growth in the figure of private insurers, which presents custom-made products. Actually, the coverage of private healthcare insurance was 67.5%, between U.S. citizens, in 2016.

The healthcare insurance market is expected to observe the enlargement by 8.9% CAGR, throughout the period of the forecast, in the Asia Pacific. Fundamentally, this would be caused by an infiltration of insurance services in the metropolitan and rural centers, an augmentation in the private and public health expenditures, together with encouraging policies by the government. The speedily rising middle-class populace, in emergent nations of the state, is increasing the demand for insurance. The life insurers, within the province, are now shifting to the products, which can provide them the protection, by means of a big focus on health as well as accident policies, instead, fee centric products.

In 2019, North America ruled the global market and held a 41.0% revenue share. The region is expected to keep on leading, during the period of the forecast. This can be credited to the existence of a big number of insurance companies, presenting life and health insurance products. Besides, the Affordable Care Act in the U.S. compels to take coverage. The states, that did not act upon, were to be punished by the central government.

The market is an extremely aggressive type. The major factors touching spirited nature are the fast implementation of highly developed equipment, for enhanced healthcare with the presentation of new-fangled products. Moreover, the companies are implementing a variety of approaches, for example, partnership, joint venture, merger & acquisition as well as expansion.

• Bupa

• Humana

• Cigna

• Allianz

• Anthem, Inc.

• United Healthcare

• Kaiser Foundation

• CVS Health Corporation

|

Report Attribute |

Details |

|

The market Size value in 2020 |

USD 2.5 trillion |

|

The revenue forecast in 2027 |

USD 4.0 trillion |

|

Growth Rate |

CAGR of 6.7% from 2020 to 2027 |

|

The base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Provider, coverage type, health insurance plans, level of coverage, demographics, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; India; Japan; China; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Key companies profiled |

United Healthcare; Aetna; Anthem, Inc.; Aviva; Allianz; Centene; Cigna; CVS Health Corporation; Humana; Kaiser Foundation; Bupa |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Million Insight's has segmented the global healthcare insurance market report on the basis of provider, coverage type, health insurance plans, level of coverage, demographics, end-use, and region:

• Provider Outlook (Revenue, USD Billion, 2016 - 2027)

• Public

• Private

• Coverage Type Outlook (Revenue, USD Billion, 2016 - 2027)

• Life Insurance

• Term Insurance

• Health Insurance Plans Outlook (Revenue, USD Billion, 2016 - 2027)

• Health Maintenance Organization (HMO) plans

• Preferred Provider Organization (PPO)

• Exclusive Provider Organization (EPO)

• Point of Service (POS)

• High Deductible Health Plan (HDHP) plans

• Level of Coverage Outlook (Revenue, USD Billion, 2016 - 2027)

• Bronze

• Silver

• Gold

• Platinum

• Demographics Outlook (Revenue, USD Billion, 2016 - 2027)

• Minors

• Adults

• Seniors

• End-use Outlook (Revenue, USD Billion, 2016 - 2027)

• Individuals

• Corporates

• Adults

• Regional Outlook (Revenue, USD Billion, 2016 - 2027)

• North America

• The U.S.

• Canada

• Europe

• The U.K.

• Germany

• France

• Italy

• Spain

• The Asia Pacific

• India

• Japan

• China

• Australia

• South Korea

• Latin America

• Brazil

• Mexico

• Argentina

• Colombia

• Middle East & Africa

• South Africa

• Saudi Arabia

• UAE

Research Support Specialist, USA