- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global team collaboration software market size was worth USD 9.5 billion in 2019. The market is projected to grow at a CAGR of 12.7% over the forecast duration. Growing digitalization has led to a surge in the visual exchange of data, which, in turn, is driving market growth. Integration of web conferencing solutions with different communication tools enables effective communication among participants. In addition, the introduction of various cost-effective video conferencing solutions is supplementing the large-scale adoption of collaboration software.

The demand for modern and smart training rooms has surged in the recent past. Advanced technologies have further improved the connectivity among employees, thus, resulting in high productivity. Meeting rooms these days are equipped with integrated and smart control systems that offer enhanced user experience. Moreover, with the use of the latest technologies having recording facilities, participants can easily take the keynote from the previously held meeting.

The growing need for seamless wireless access among enterprises is driving the demand for team collaboration software. Service providers are offering mobility solutions in collaboration with other companies to facilitate communication from even remote locations. For example, Microsoft Corporation in collaboration with Steelcase Inc. and Schneider Electric announced that it would offer APC Charge Mobile Battery and Roam Mobile Stand. These solutions will allow the creation of creative content and delivery on the go.

Further, the emergence of Application Program Interfaces (APIs) allows enterprises to build a solution for different devices and ensure a secure collection of data. Feedbacks obtained from users result in the improvement of existing solutions offered by companies. Further, team collaboration software helps in facilitating real-time communication among different teams. With the help of APIs, enterprises can easily collaborate with remote workers and on-site workers.

Coronavirus Disease (COVID-19) has been termed as a pandemic by the World Health Organization. It has been made mandatory for employees to work from their homes, which led enterprises to develop a solution that can control their employees from a remote location. The growing need for establishing effective communication among different employee groups and management. This factor, in turn, is supplementing the growth of the market.

The growing need for enterprises to conduct video conferencing and ensure efficient operation of their businesses is propelling the market growth. However, video conferencing solutions pose security risks as well. Growing instances of data leaks and hacking by individuals are projected to adversely affect the market growth over the forecast years. Further, the ongoing economic slowdown discourages enterprises from investing heavily, thereby, slowing the growth of the market.

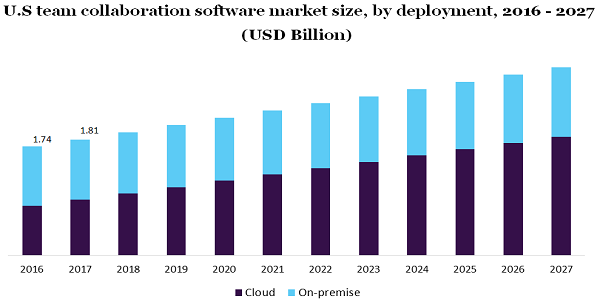

By deployment, the team collaboration software market is divided into on-premise and cloud. Of them, the on-premise segment accounted for 55.05% of the market share in 2019. Factors such as data security and meeting compliance are driving on-premise adoption. On-premise further helps in ensuring low latency during the transfer of data, thereby, helping organizations in the cost-effective management of data.

In 2019, cloud deployment accounted for a considerable market share. Factors such as maintenance costs, staff training, and the low initial cost are expected to bolster the growth of cloud deployment. Moreover, the cloud enables the accessibility of data from a remote location. Ease associated with cloud deployment offers a competitive advantage to the enterprises, thereby, supplementing the market growth.

In 2019, software for communication and coordination accounted for 58.16% of the market share. This software allows the sharing of real-time data that helps in establishing better connections among different teams through voice mails, conferencing, and instant messaging. Efficient communication among teams ensures high productivity, thereby, leading to high adoption of such software.

On the other hand, in 2019, the conferencing category accounted for a considerable market share. The growing adoption of Virtual Reality (VR) and Augmented Reality (AR) based software for collaboration is driving this segment demand. These technologies help in creating holograms that enhance the quality of the presentation. Moreover, VR and AR can create the virtual presence of individuals thereby, enabling effective relationships among employees.

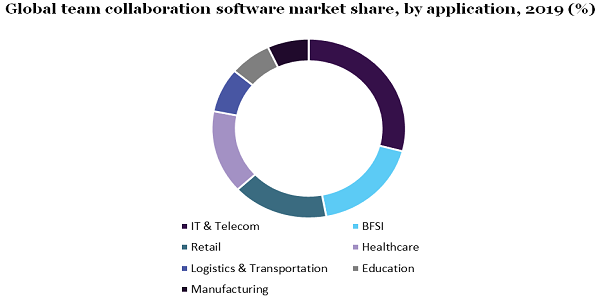

Based on applications, in 2019, the IT & Telecom segment accounted for 29.10% of the market share. Growing demand for Unified Communication as a Service (UCaaS) among enterprises to enable effective collaboration is offering a lucrative opportunity for market growth. Major telecom players such as AT&T Inc. are collaborating with OTT media providers. Further, the growing need for video conferencing solutions among enterprises is expected to boost the market growth over the forecast period.

In 2019, the BFSI sector occupied over 20% of the team collaboration software market share. Growing digitalization across the banking system and the need for efficient communication among different employees groups are driving the growth of the market. BFSI sector is emphasizing improved connectivity among different branches located at remote locations. Collaboration software reduces the communication time between different departments and hence increases productivity.

In 2019, North America accounted for 31.38% of the market share. Increasing IT spending to increase employees’ productivity and transform legacy systems is attributing to the growth of this region. Further, enterprises are focusing on increasing end-to-end security in communication systems. This factor is projected to propel the market growth over the forecast duration.

The Asia Pacific is anticipated to register the highest growth rate over the next seven six years. The growing number of smartphone users, cloud providers, and rising investment in infrastructural development is driving regional growth. Government initiatives such as Startup India, Make in India and the 2018-immigration bill in Japan have further driven the need to establish an efficient team collaboration system.

Industry players are offering cloud-based solutions for the enterprise that can be easily integrated with the existing system. Growing security and safety measures further encourage the adoption of collaboration software. To integrate business intelligence dashboards, service providers offer integrated analytics tools. For example, Microsoft 365 offers the Power Business Intelligence Tool. This tool helps in measuring the success of team collaboration software. Key players operating in the market are Avaya Inc., IBM Corporation, Avaya Inc., Adobe System Incorporated, and Microsoft Corporation.

|

Report Attribute |

Details |

|

The market size value in 2020 |

USD 10.5 billion |

|

The revenue forecast in 2027 |

USD 24.2 billion |

|

Growth Rate |

CAGR of 12.7% from 2020 to 2027 |

|

The base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, software, application, and region |

|

Regional scope |

North America; Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil; Mexico |

|

Key companies profiled |

Adobe Systems Incorporated; Avaya Inc.; AT&T, Inc.; IBM Corporation; and Microsoft Corporation. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2027. For the purpose of this study, Million Insights has segmented the global team collaboration software market report based on deployment, software, application, and region:

• Deployment Outlook (Revenue, USD Million, 2016 - 2027)

• Cloud

• On-premise

• Software Type Outlook (Revenue, USD Million, 2016 - 2027)

• Conferencing

• Communication and Coordination

• Application Outlook (Revenue, USD Million, 2016 - 2027)

• Manufacturing

• BFSI

• IT & Telecom

• Retail

• Healthcare

• Logistics & Transportation

• Education

• Regional Outlook (Revenue, USD Million, 2016 - 2027)

• North America

• U.S.

• Canada

• Europe

• Germany

• U.K.

• the Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Mexico

• MEA

Research Support Specialist, USA